Weekly Summary: July 26 – 30, 2021

Key Observations:

- The Delta variant has provided the Fed with greater latitude as to the timing of any change in its easy monetary policies.

- The Fed’s focus on maximum employment continues. We believe that the Fed’s willingness to switch to less accommodative monetary policies will be affected by workers’ willingness to return to the workforce over Delta variant concerns.

- The U.K.’s Delta variant experience makes us optimistic that this variant will be manageable.

- We believe that the Delta variant will slow reopenings and economic growth rates but not derail them. Our “rolling” economic growth assumptions are only delayed, especially with regard to EMs.

- Although real U.S. Q2 GDP growth was a disappointing +6.5% q/q, the underlying economic data was actually supportive of our optimistic 2H economic growth expectations.

The Upshot: Our investment approach remains unchanged. We remain opportunistic buyers of value and cyclical stocks. We continue to hold core positions in big-cap quality growth stocks. We believe in the effectiveness of the “barbell” approach in the current environment.

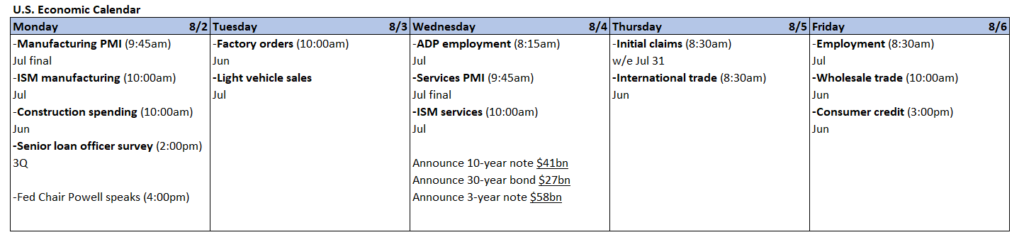

The Delta variant has provided the Fed with greater latitude, enabling it to maintain its easy monetary policies. In its statement at the conclusion of its mid-week meeting, the Fed noted that the “path of the recovery continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.” Fed Chair Powell made it clear in his press conference that the Fed was still not prepared to act. The Fed’s focus continues to be on the labor market, which Powell indicated is still “some way away” from justifying tapering of the Fed’s asset purchase schedule. But the Fed’s statement also indicated that “in coming meetings,” the FOMC will continue to assess the extent to which “substantial further progress” has been achieved toward its goals of maximum employment and price stability.

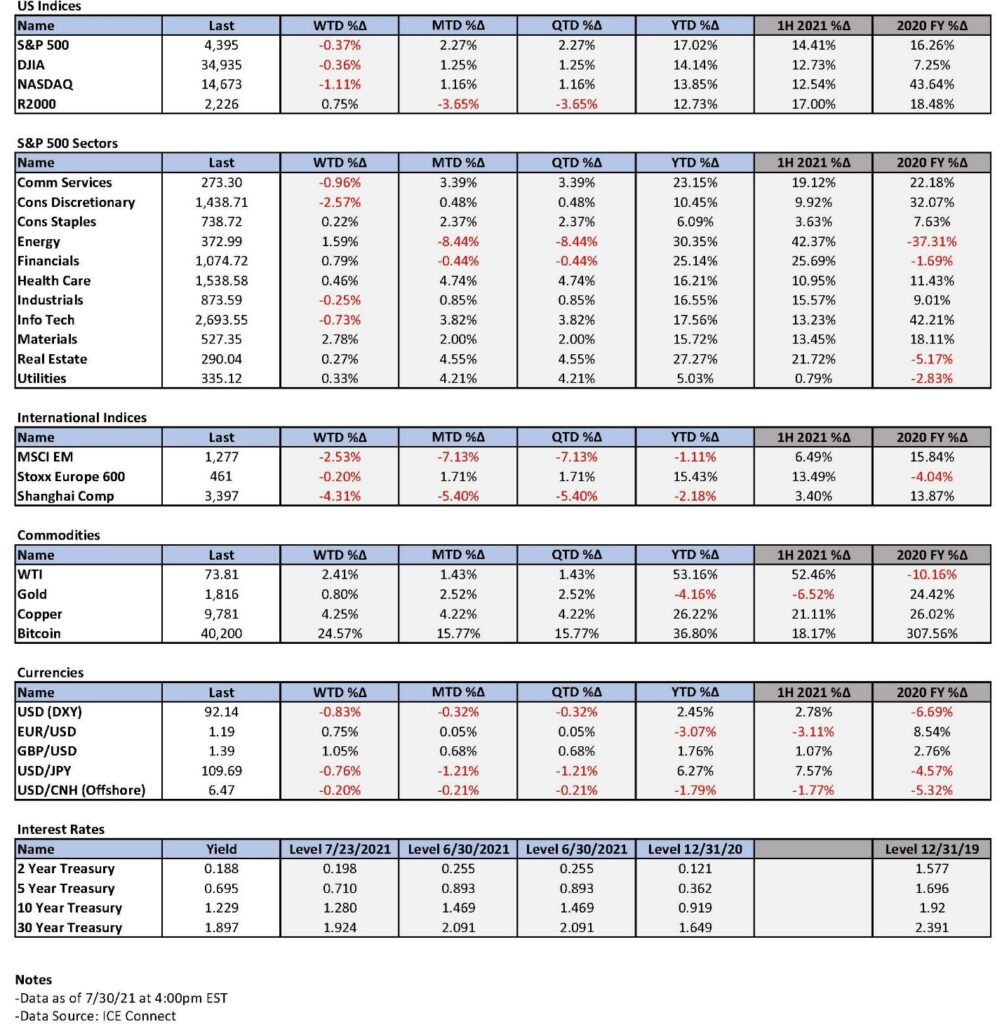

The markets interpreted the Fed’s statements as “dovish.” Although still slightly negative for the day, both the S&P 500 and the Dow Jones moved higher subsequent to the Fed announcement. Both the Nasdaq and Russell 2000 were positive before the Fed statement and closed the day significantly higher. The 10-year yield was slightly higher before and subsequently lost 1 basis point to close at 1.23%. USD went from a slight gain to a slightly bigger loss.

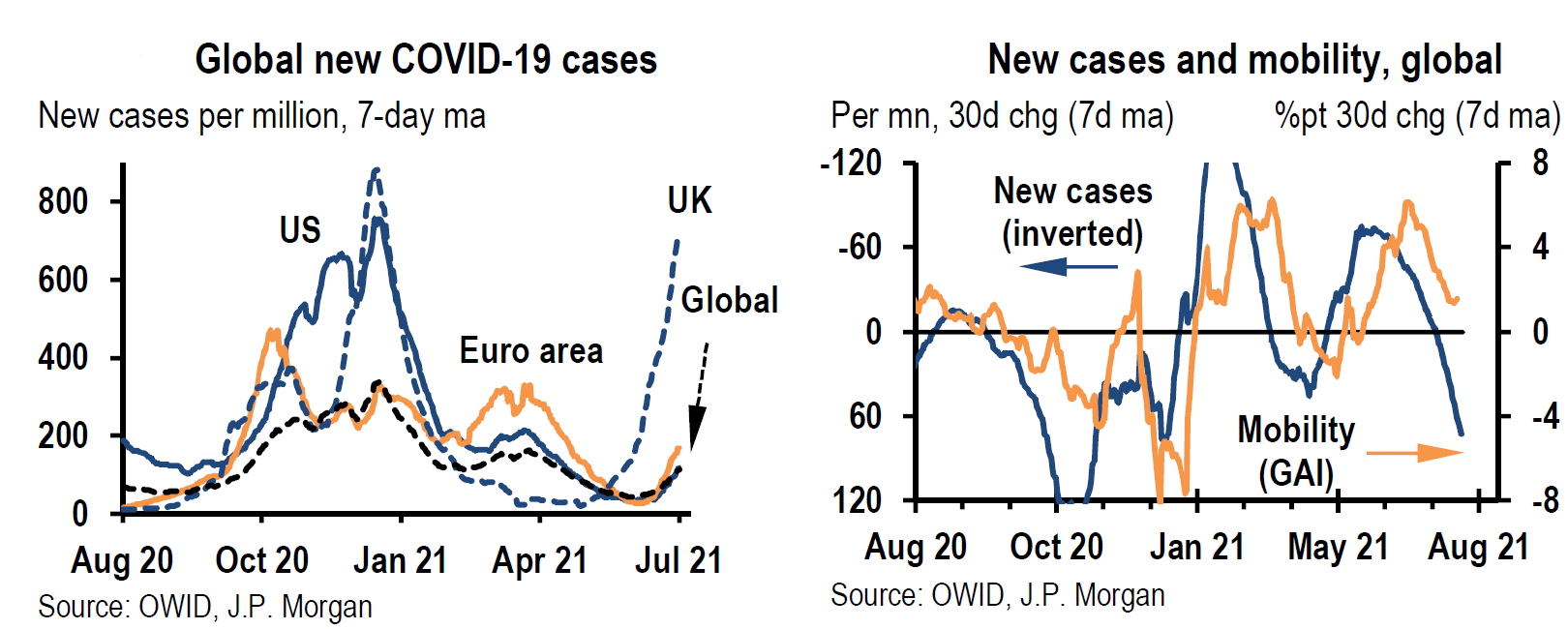

Powell pointed out that with each successive wave of the COVID-19 virus, the economic effects were less negative. But he acknowledged the seriousness of the Delta variant and thought that its presence might “weigh” on people’s willingness to return to work. The Delta variant has injected yet another layer of uncertainty in regard to the reopening of the U.S. and global economies. It is generally accepted that the pace of economic growth will be affected by this variant. Vaccination levels within respective countries could greatly affect the resilience of their economies.

U.K.’s Delta Variant Experience as a Paradigm

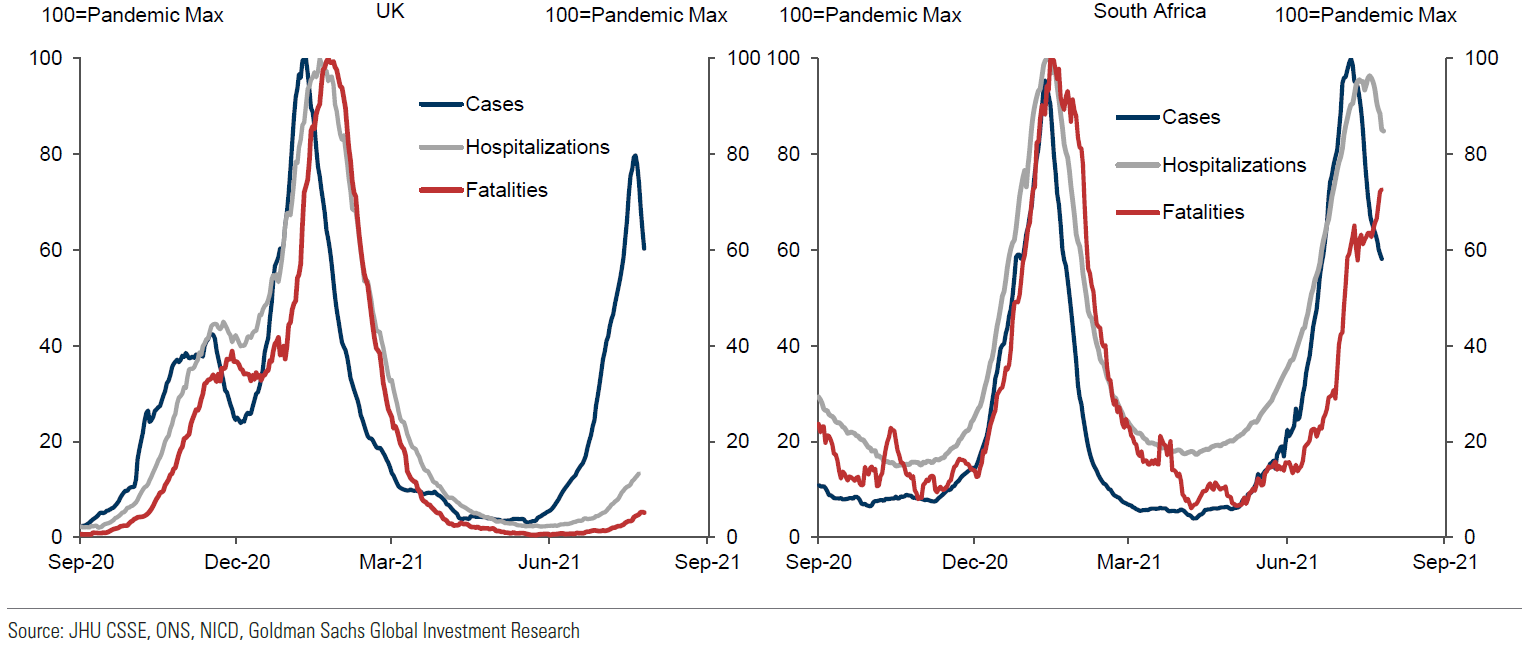

Even though India was the first country to detect and suffer from the Delta variant, the ongoing experience of the U.K. is now accepted as the paradigm for the Delta variant’s effect on countries with high vaccination rates. The U.K. observations are rather encouraging. U.K. cases of COVID-19 started to spike dramatically in June, mostly due to the Delta variant, before the number of new cases began to significantly drop over the past week. On July 26, J.P. Morgan (JPM) cited that despite the very quick increases in new virus cases, the mortality rate was 95% below the January peak. Hospitalization rates were also dramatically lower compared to the number of new cases.

U.K. policymakers seemed to acknowledge the effectiveness of the two-dose vaccines against the Delta variant, which generally prevented serious illness. This was a welcome development, demonstrating that the correlation between new virus cases and lessened mobility can be broken as vaccination rates increase. The U.K. government recently continued to relax virus-related restrictions, implementing a more lenient policy on entry into the U.K. for U.S. and European visitors who are fully vaccinated.

Other European countries seem to be following a pattern very similar to the U.K. The July increase in mobility in the eurozone, along with very positive PMI numbers, especially in regard to its services sectors, is very encouraging for continued economic expansion. New virus cases started increasing about three weeks ago in the U.S., even in states with high vaccination rates. These increases were concentrated in states with high levels of restaurant spending, high temperatures and low vaccination rates. Once again, the U.K. paradigm seems to fit. The response of policymakers and individuals’ reactions to the Delta variant will also be very influential with respect to its ultimate economic effects.

Source: Goldman Sachs – Tracking Virus and Vaccines: July 27th (7/27/21)

Uneven Effects From Delta Variant

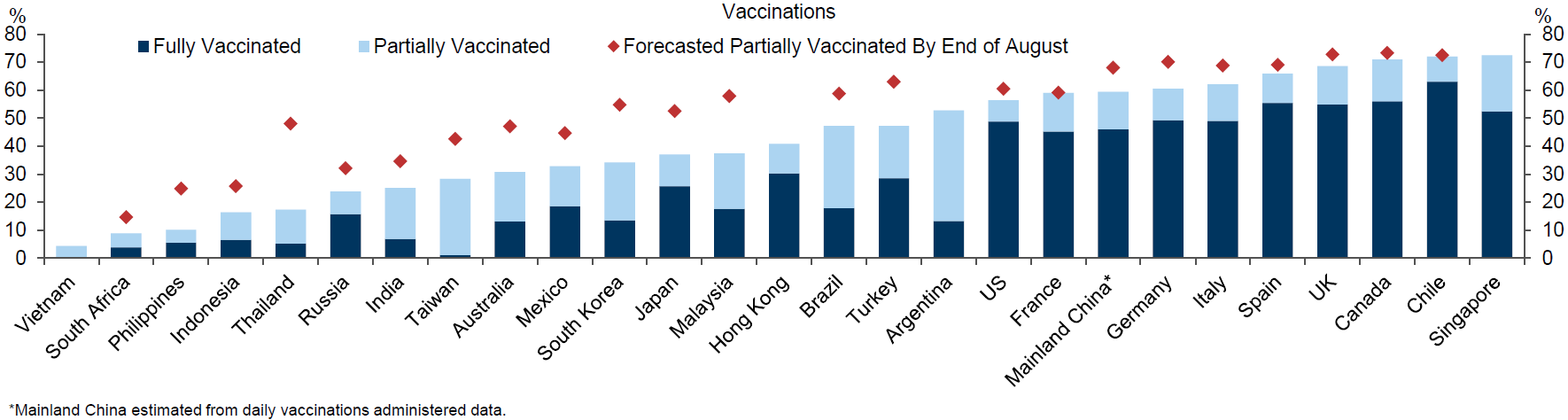

The Delta variant will most likely exacerbate the uneven effects of the pandemic. Countries with relatively low vaccination rates, such as many emerging market countries (EMs), will most likely experience even more Delta variant cases, which should be more serious. Hopefully, more hospitalizations in such countries will not overwhelm their healthcare facilities. The more recent rapid increase in vaccination rates in such countries should help prevent such outcomes.

JPM estimates that the GDP-weighted share of fully vaccinated people still only averages about 35% of the countries in JPM’s coverage. Nevertheless, the continuing increase in vaccination rates should be sufficient to unleash pent-up demand in 2H of this year. We expect global infections to peak in Q3, surpassing even the second-wave peak of the pandemic. But higher vaccination rates should keep hospitalization and death rates much lower. Although EM growth might be delayed, we still expect it to at least start to converge with DM (developed markets) growth sometime in Q4. We also expect USD weakness into year-end to eventually help boost EM economic growth. As of July 27, EMs were underperforming DMs by about 11% YTD.

J.P. Morgan – US Market Intelligence: Morning Briefing (7/29/21)

Delta Variant as a Correlations Disruptor

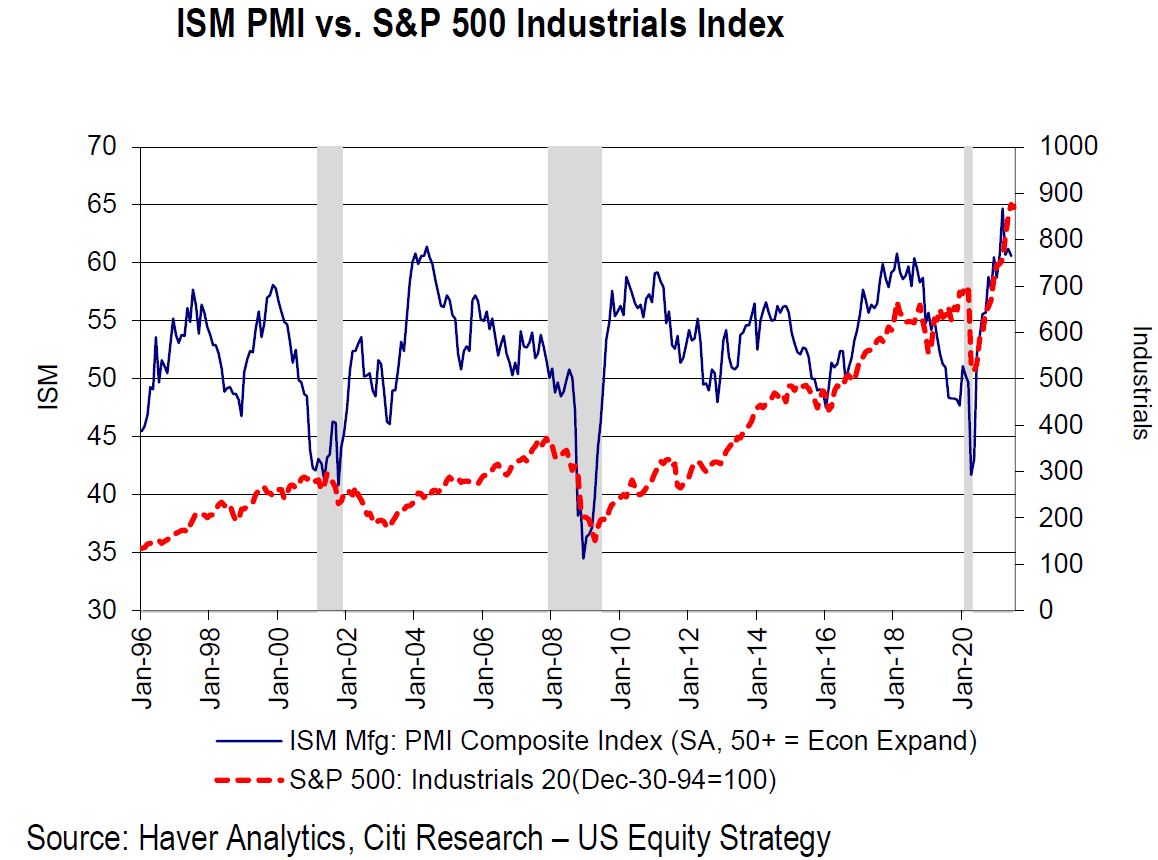

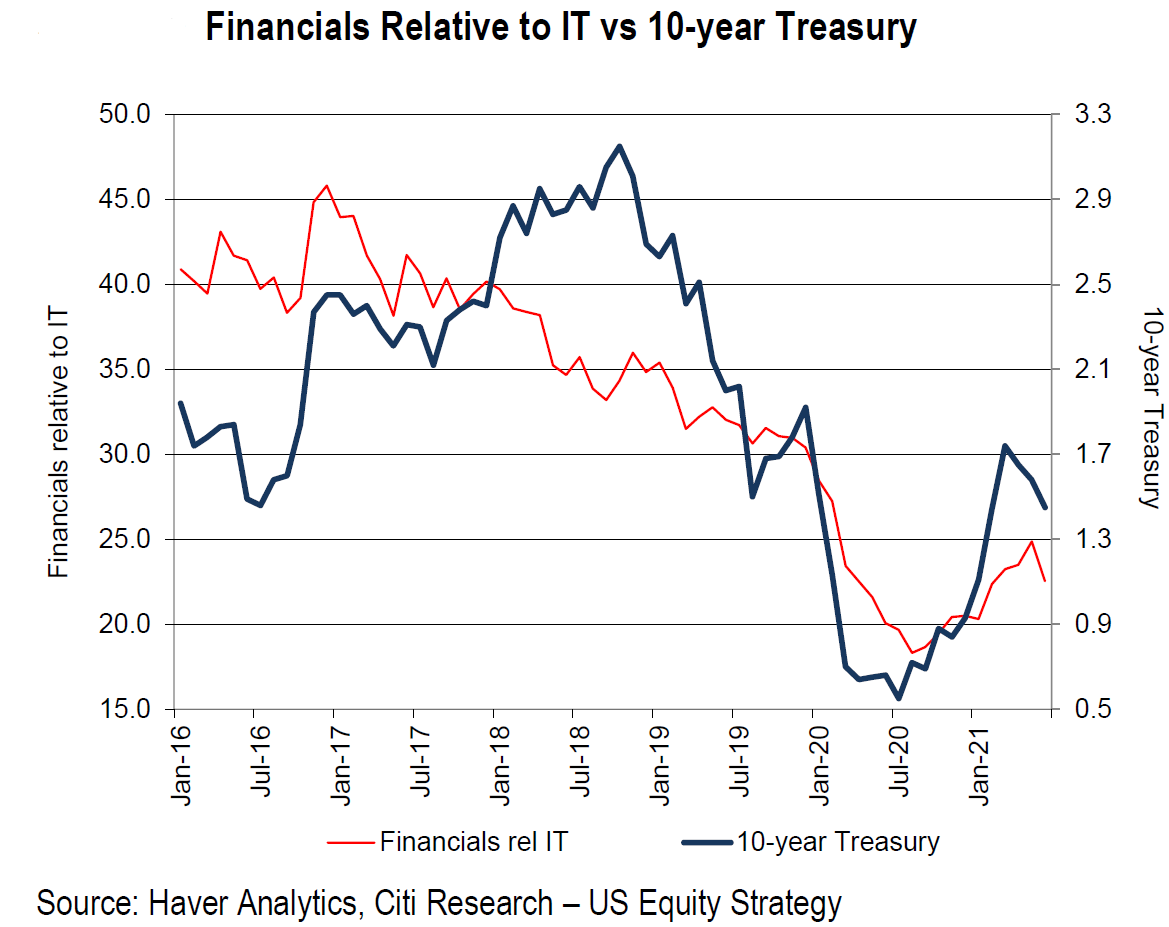

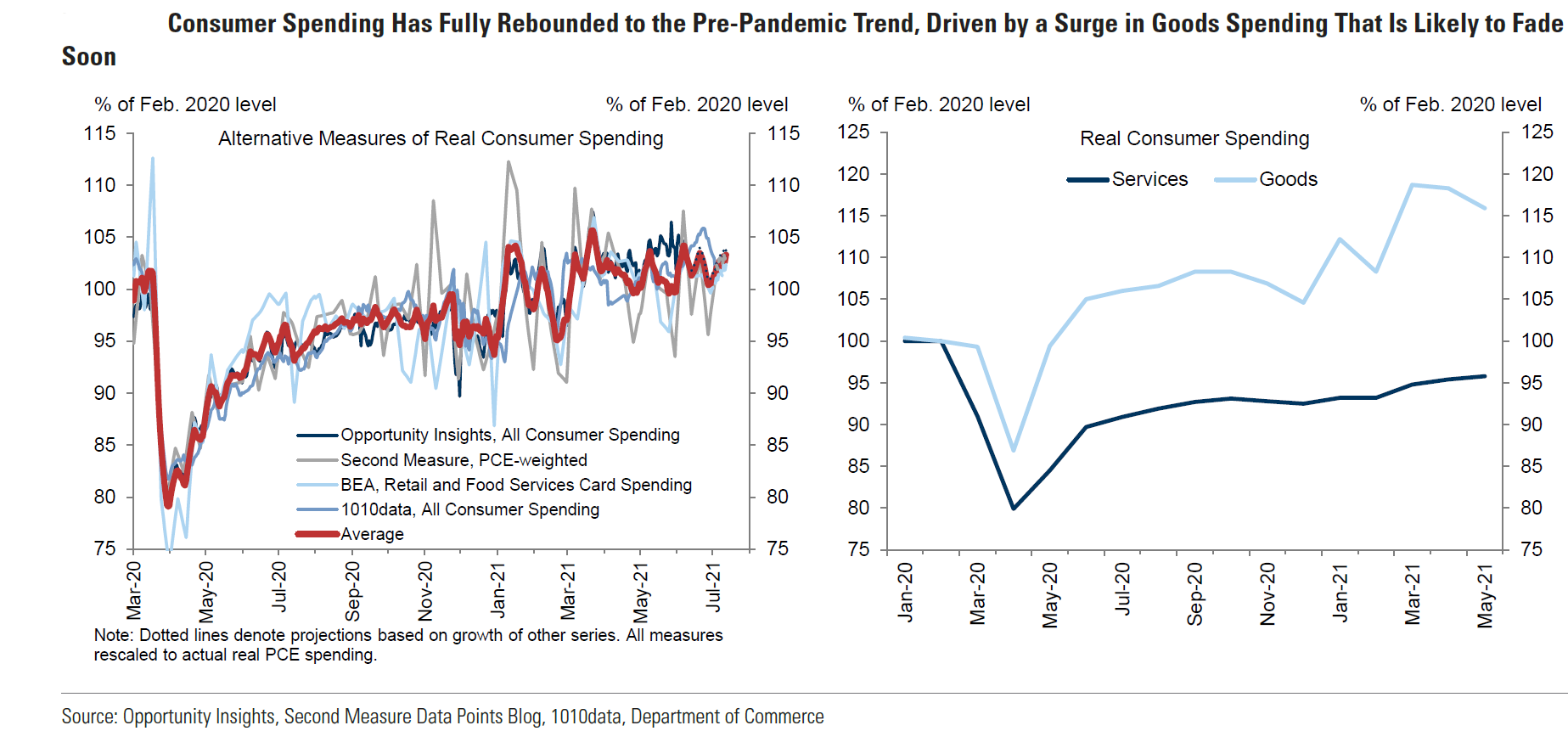

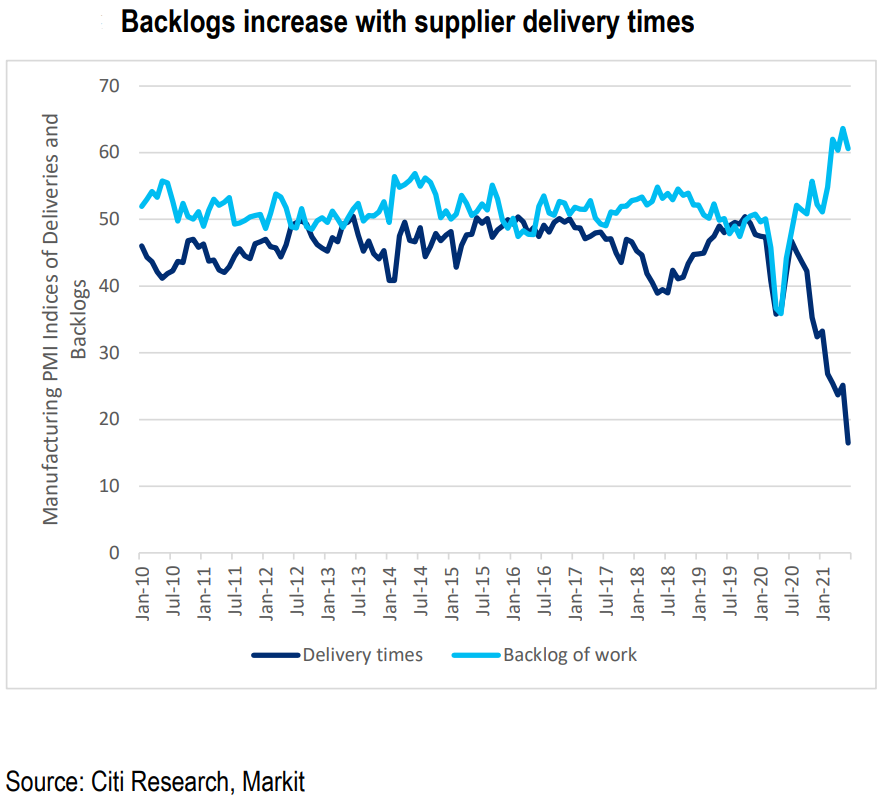

ISM/PMI (measures of economic growth) have been closely correlated to the movement of the S&P 500 industrials index. The performance of financial stocks relative to info tech stocks has been heavily influenced by the 10-year Treasury yield. The Delta variant’s effect on economies could meaningfully alter the trajectories of relationships such as these. The transition from far-above-trend spending on goods to more focused spending on services could be delayed. Perhaps the Delta variant can account for the slower-than-expected recovery in services spending.

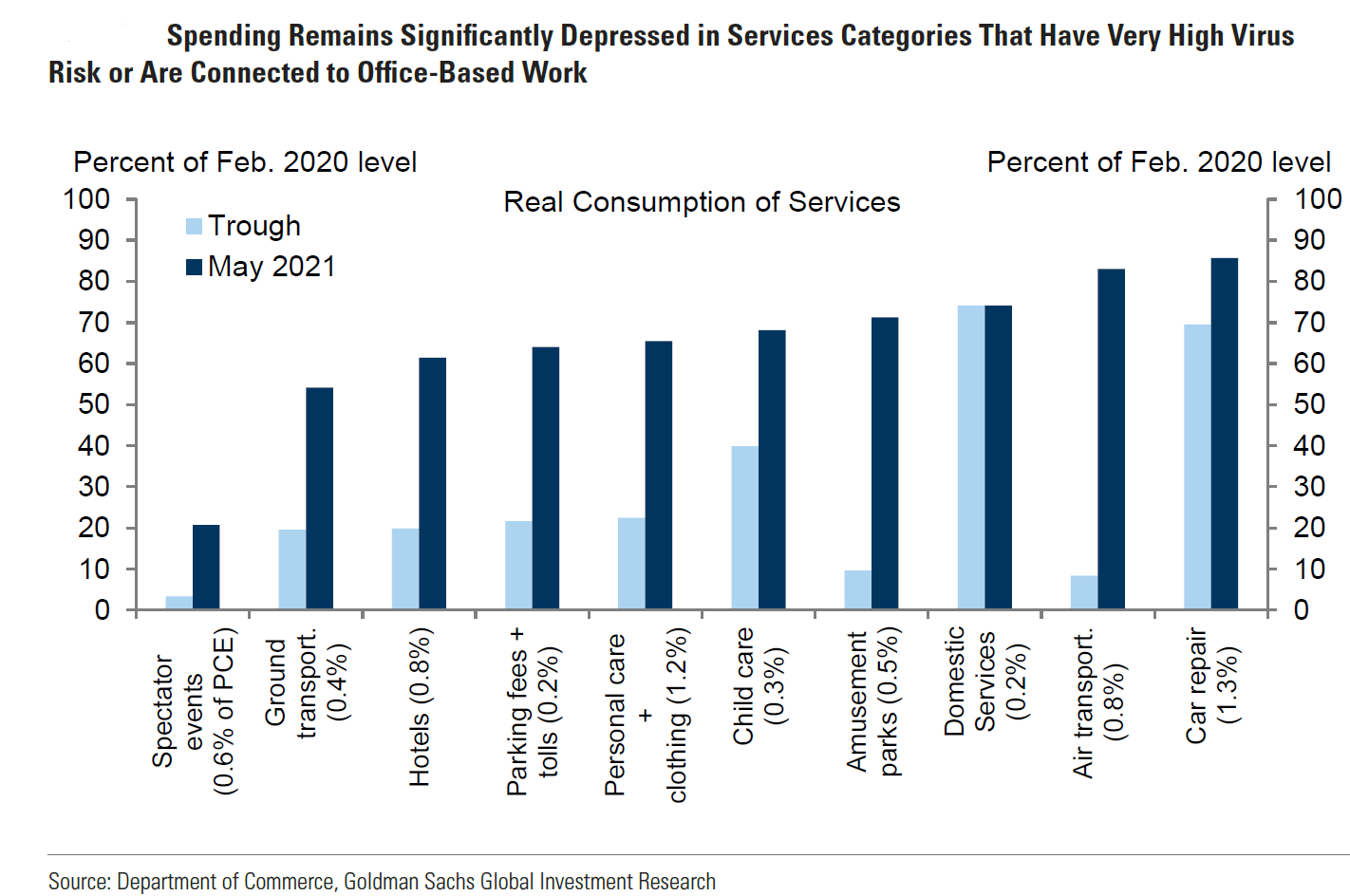

According to a Goldman Sachs report on July 26, U.S. office attendance in large cities is still at just one-third of pre-pandemic levels, and ads for job openings increasingly offer remote work. The services tied most closely to events with large crowds and high virus risk such as live entertainment events and amusement parks, or connected to office-based work such as dry cleaners and child care, remain especially depressed. Due to factors such as these, Goldman Sachs now forecasts an end-of-year U.S. unemployment rate of 4.4% versus its prior forecast of 4.2%.

Source: Citi – Monday Morning Musings: Peak Blinders? (7/23/21)

Source: Goldman Sachs – US Economics Analyst After Peak Growth: A Slightly Slower Service Sector Recovery (7/26/21)

Q2 Earnings Reports Insights

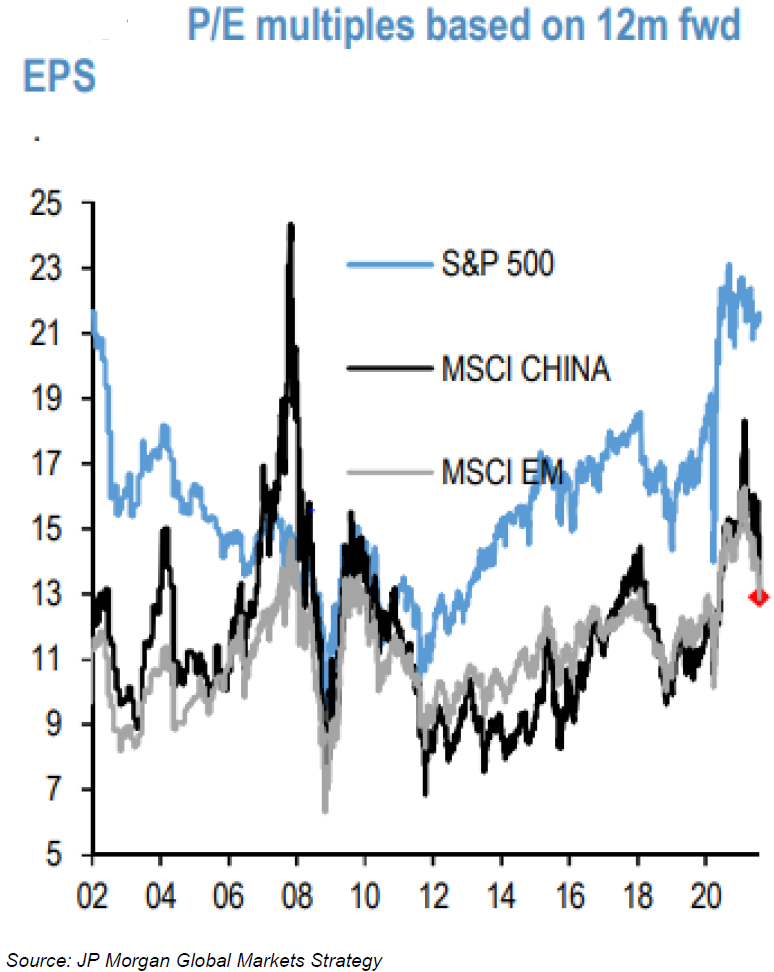

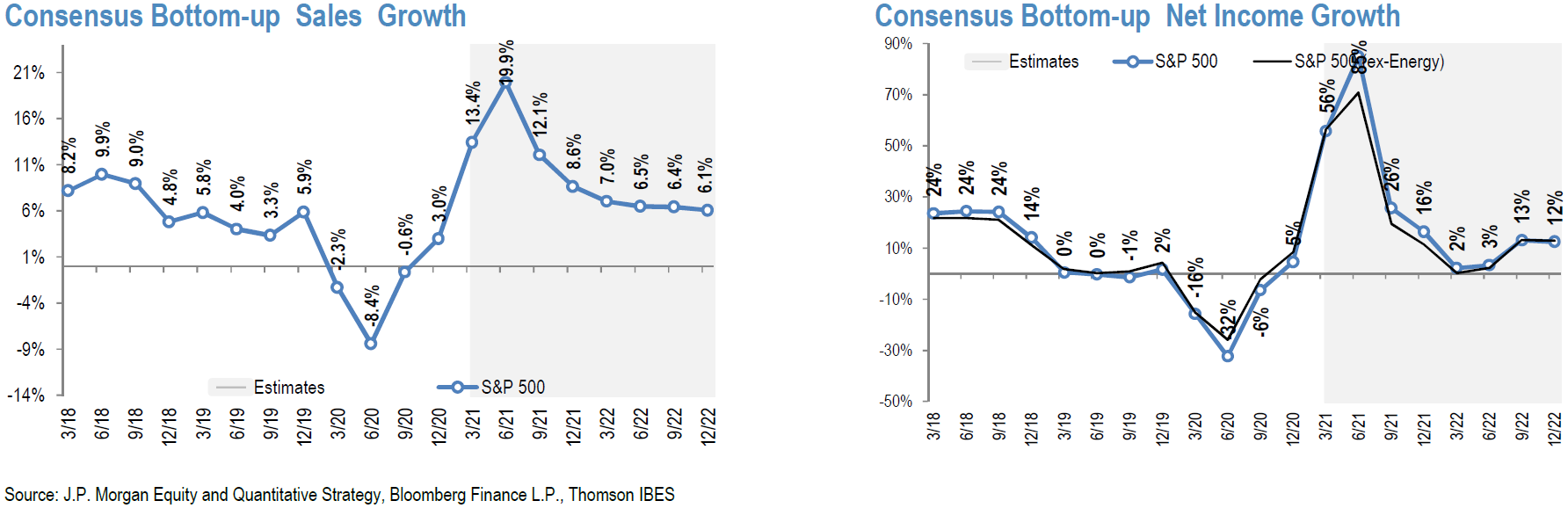

According to a FactSet report on July 23, with 24% of S&P 500 companies reporting, well over 80% continue to beat earnings and revenue estimates. Other reports confirmed these trends after 34% of S&P companies reported. FactSet estimates that the 12-month forward P/E ratio is 21.3x vs. the 5-year average of 18.1x and even further above the 10-year average. FactSet’s projected Q2 profit margins are 12.4%, which are the second highest since 2008. Profit margins are expected to remain at least 12% through this year.

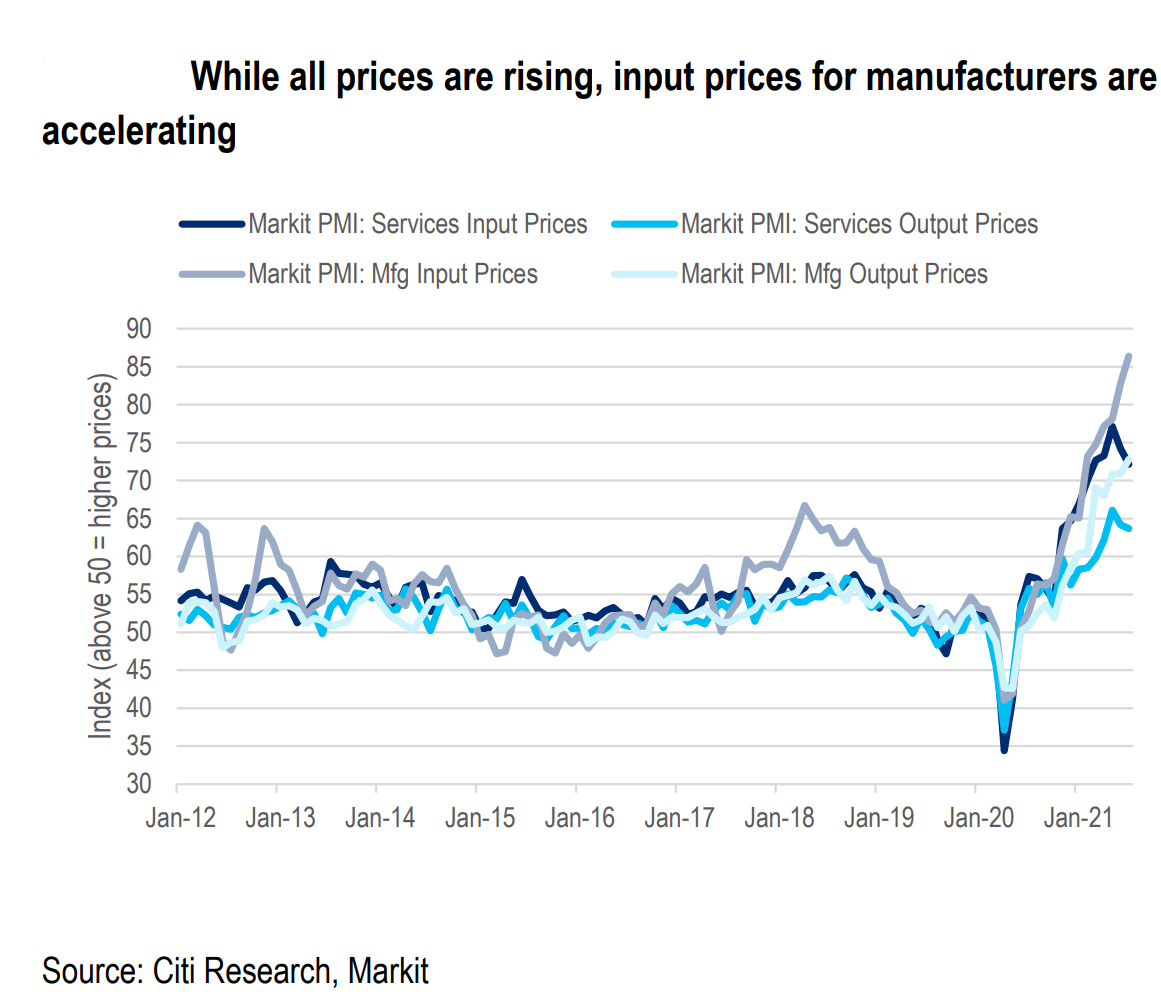

The Delta variant could easily disrupt this forecast, as it could lead to labor shortages and supply chain disruptions. The result would be lower production rates, lower economic growth rates and higher inflation, especially of input prices. We expect that this could result in lower margins, which could temporarily lower equity prices. Given the U.K. paradigm with respect to the Delta variant, we expect that investors will be able to look past the negative effects from the variant, just as many have been able to look past the current very high levels of inflation.

We believe that the Delta variant will be manageable, delaying reopenings and economic growth, but not derailing the projected positive outcomes. This is in contrast to our belief that a significant part of the current high inflation rates will prove to be more persistent than many investors expect.

Source: J.P. Morgan – S&P 500 2Q21 Earnings Update (7/30/21)

Q2 Reports — Margins and Expectations

Perhaps fear of margin compression due in part to the Delta variant can explain why, on average, according to a Morgan Stanley report on July 26, the stocks of companies that exceed earnings expectations underperform relative to the overall equity market based on trading three days after they report. We believe that the general and continued muted response to positive earnings surprises can at least partly account for Goldman Sachs’ estimate of +/-2.8% average stock price movement on reporting of earnings day versus the 15-year average of +/- 3.5% (like-for-like baskets). These figures are based on 26% of S&P 500 stocks reporting through July 27.

Another clear example of high expectations being built into stock prices is that with 65% of financials having reported, the average financial stock gained only 0.3% on reporting day. We believe that the Delta variant could potentially reduce very high expectations, which could negatively hurt high-expectation stocks more than stocks with relatively lowered expectations.

With the exception of Alphabet (Google), very-high-expectation stocks such as Apple, Microsoft and Facebook had very muted or negative stock price reactions to very strong earnings and revenue reports this week. Such stocks remain vulnerable to any disappointments. Although Amazon exceeded its earnings expectations, it disappointed vs. Q2 revenue estimates and guided Q3 revenue estimates lower as well. Amazon’s stock price traded at least 7% lower in after-hours trading.

The lack of at least a 5% pullback in the S&P 500 index in over 180 days, which is about twice as long as the historical average, serves as a reminder of potential market vulnerabilities. Of course, periods without 5% corrections can continue for quite some time longer. Although growth and defensive-type equities have been supported by falling bond yields, fading optimism for continued rapid economic expansion should lead to more volatility, in our opinion. We expect these growth concerns to moderate as the Delta variant’s effect on economic growth is more clearly defined.

Source: J.P. Morgan – Global Data Watch (7/23/21)

Remain Opportunistic Buyers

We remain opportunistic buyers of Value, cyclical and reopening-type stocks on pullbacks. These types of stocks have already assumed disappointing and/or slower economic growth rates. Many of them are already off their highs. In spite of the near-term vulnerability of quality big-cap growth equities, we remain holders of the bulk of such positions for long-term appreciation potential.

All of the economic data and surveys reported this week were generally consistent with prior reports and supportive of our inclination to continue to be buyers of value and cyclical stocks on pullbacks. An example of this was the Dallas Fed survey of manufacturers, who believed that business conditions continued to improve in July. Other comments from this survey included that wage pressures were very significant, especially in regard to skilled and semi-skilled workers. Concerns were also expressed about whether sales growth could be maintained without adequate and more consistent inventory levels. Inventory replenishment will eventually lead to improved production levels and further economic growth.

The U.S. Conference Board’s Consumer Confidence Survey® provided further optimism for continued economic growth, as it remained relatively unchanged in July following gains in each of the prior months but remained close to its highest level since February 2020. It was also encouraging that spending expectations rose in July despite continued high inflation expectations.

Q2 U.S. Real GDP Growth — Better Under the Surface

The disappointing U.S. real Q2 U.S. GDP (expressed in constant USDs from a base level) annualized growth rate of 6.5% q/q vs. 8.4% consensus expectations and 12.2% y/y, did not change our conviction that 2H will continue to show strong economic growth. Once again, the pandemic continued to negatively affect production through supply disruptions, inflation and labor shortages. Negative contributions of 1.1% due to falling inventories, -0.4% from rising net imports and -0.4% from lowered federal government spending all greatly affected the headline number.

But consumption rose a very strong 11.8%, led by a 12% increase in services spending as the U.S. economy was reopening. Structural investment disappointed, with sizable declines in both residential and nonresidential investments. But business equipment spending rose a very strong 13%, as did intellectual property investment with a gain of 10.7%. Evidently, the markets agreed with our assessment as the 10-year Treasury yield increased by at least 4 bps during the day to 1.27%.

The S&P sectors showed a strong tilt to Value and cyclical stocks after a more mixed picture of the best-performing sectors earlier this week. But energy and materials remained among the three top-performing sectors after the fourth day of trading, as the financial sector was becoming revitalized. The info tech sector was a notable laggard during this week, while USD accelerated its decline as well.

Source: Citi – US Economics: PMI show inflationary supply-side constraints intensifying (7/23/21)

Source: Citi – US Economics: Supply chains stretched as PMI’s remain in expansionary territory (7/23/21)

China Crackdown on Internet and For-Profit Education Companies

China provided us with an extreme example this week of how increased regulations and scrutiny might affect certain sectors and types of companies. The U.S. mega-cap internet quality growth stocks have increasingly become the focus of President Biden’s administration and U.S. regulators, especially in regard to antitrust issues. Of course, it could take many years before any U.S. regulatory and/or antitrust actions are realized.

But the Chinese have highlighted potential issues that could become relevant for similar internet-type companies. On July 26, the Ministry of Industry and Information Technology (MIIT) of China announced the establishment of a special task force to focus on China’s internet sector and to implement regulations over the next six months. According to a Citi Research report on July 27, MIIT’s “Action” will aim to regulate China’s internet industry, focusing on social aspects, broad influence and those issues that could lead to strong public opinions, so that the overall industry could become more open and safe, functioning in an orderly manner to assure quality growth of the sector.

China obviously does not want their large internet companies to have such significant sway over public opinion. One way to ensure this outcome is to foster more competition. Another way is through more specific regulations as to what behavior is allowed and disallowed. China’s crackdown on for-profit education/tutoring companies is further evidence of the government’s determination to control information that is dispensed to its populace. It also seems that these efforts are partly intended to discourage foreign investment in companies that could influence Chinese opinions, especially through such for-profit education/tutoring companies.

These actions precipitated massive declines in mainland stocks as well as stocks traded in Hong Kong. According to a Goldman Sachs report on July 29, MSCI China has underperformed global equities by 30% since its peak in February, with consumer services and technology especially hard hit. Goldman estimates that about $1 trillion of market value of “China Tech” has been lost from its mid-February level of $3 trillion. MSCI China fell about 13% in just the last few days alone.

China’s Objectives

China’s ultimate objectives through any new regulatory actions are “common prosperity” and “social responsibility.” These objectives will be prioritized over capital markets concerns. Many of the affected stocks rebounded after China’s government tried to reassure investors that they have misunderstood the regulator’s actions. We are not suggesting that any such actions are even remotely possible in the U.S. or Europe, and we certainly do not anticipate any such severe declines in stock prices in the foreseeable future. We just wanted to highlight that increased regulations and scrutiny could become more of a concern at any time.

Government Policies Do Matter — Energy as an Example

As the above discussion illustrates, government policies do matter. Zero-carbon emissions policies are yet another important example. According to a JPM report on July 27, countries representing about 70% of global GDP have announced net-zero carbon emissions policies. Even though the realization of this goal is decades away, such policies have tended to discourage investments in fossil fuels. Such underinvestment could easily lead to fossil fuel capacity shrinking faster than demand switches to renewables. In the short term, the Delta variant could negatively affect energy demand. But longer term, such policies should provide support for energy prices and be encouraging to long-term energy investors.

Uncertainties Affect Business Confidence

But uncertainties remain on a global basis. The increase in Delta variant cases and inflation expectations, along with concerns about supply chain disruptions and the ability to maintain margins all add up to increasing uncertainties about the future. We assume that concerns such as these led to a sharp fall in Germany’s Ifo Business Climate Index in July. Although the current assessment component of this index actually increased in July to above its long run average, it was the sharp fall in the expectations component that brought the overall index lower.

Bottom Line

The Delta variant has become a great disruptor to an assumed progression of economic reopenings and growth rates, accentuating the uneven effects of the pandemic. These uneven effects also include further supply chain disruptions, both real and potential, and more questions regarding labor force needs and continued pockets of inflation.

By extending disruptions that often lead to rising inflation, we believe the Delta variant will ultimately lead to increased inflation expectations. The longer inflation persists, whether it’s classified as transitory or more persistent, will not matter after an extended time. People become accustomed to the current state of the world. Continued wage gains will have the same effect. The longer one sees something, the more it is expected to persist.

Energy prices will continue to play a critical role in regard to inflation expectations. If energy prices continue to rise, consumers will be constantly reminded of it every time they need more fuel. The resulting rise in shipping costs will also be a constant reminder of increasing prices. The adoption of zero-carbon emissions policies by many countries will only serve to exacerbate the rise of energy prices over the intermediate to longer term. Of course, most investors are currently focused on the Delta variant’s effect on the demand for energy, but it affects the supply side as well.

The increasing level of uncertainty due to the Delta variant and the continued rise in inflation is beginning to affect the level of business confidence with respect to the future. We believe business confidence about the future will rebound once more people realize that the Delta variant is indeed manageable.

This general unease about the future has helped restrain the upward trajectory of “high-expectation” stocks, even as they greatly exceed their earnings and revenue expectations. “Low-expectation” stocks such as value and cyclical stocks should be less prone to general stock price declines since most have already “disappointed” in some way. They are certainly not priced for perfection. Although China’s recent regulatory crackdown on internet and education-related companies is not directly relevant to most DM markets, it is certainly a reminder that government policies do, in fact, matter. The lack of at least a 5% correction for an extended period of time is also noteworthy.

This is a liquidity-driven market — at least in equities and bonds. Investors are buying not because they believe current price levels are compelling, but only because there are no other compelling opportunities. We are very confident that compelling investment opportunities will reappear — they always do. Patience will eventually be rewarded. In the meantime, we retain our investment posture. Keep core positions, and selectively buy when the opportunities arise.

Index Definitions:

VIX: The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Russell 1000 Value: The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted and historical growth values.

NASDAQ: The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

S&P 500: The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

MSCI EM Value Index: The MSCI Emerging Markets Value Index captures large and mid cap securities exhibiting overall value style characteristics across 27 Emerging Markets (EM) countries

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries

KBW Nasdaq Bank Index (BKX): The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2021 NewEdge Capital Group, LLC