Weekly Summary: September 6 – 10, 2021

Key Observations:

- Positioning in U.S. equities is extremely one-sided and bullish. Positioning in European equities is much more moderate and two-sided.

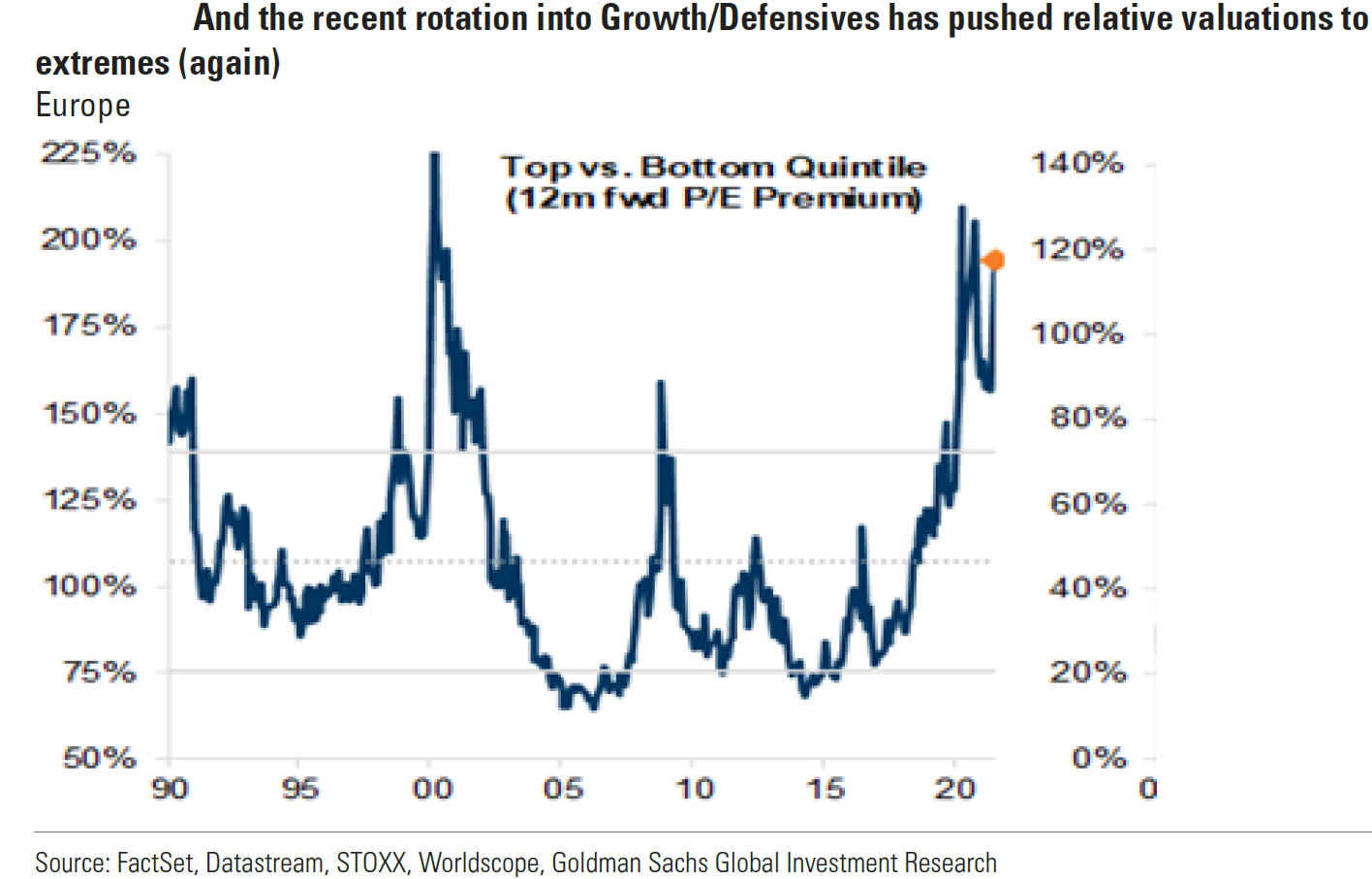

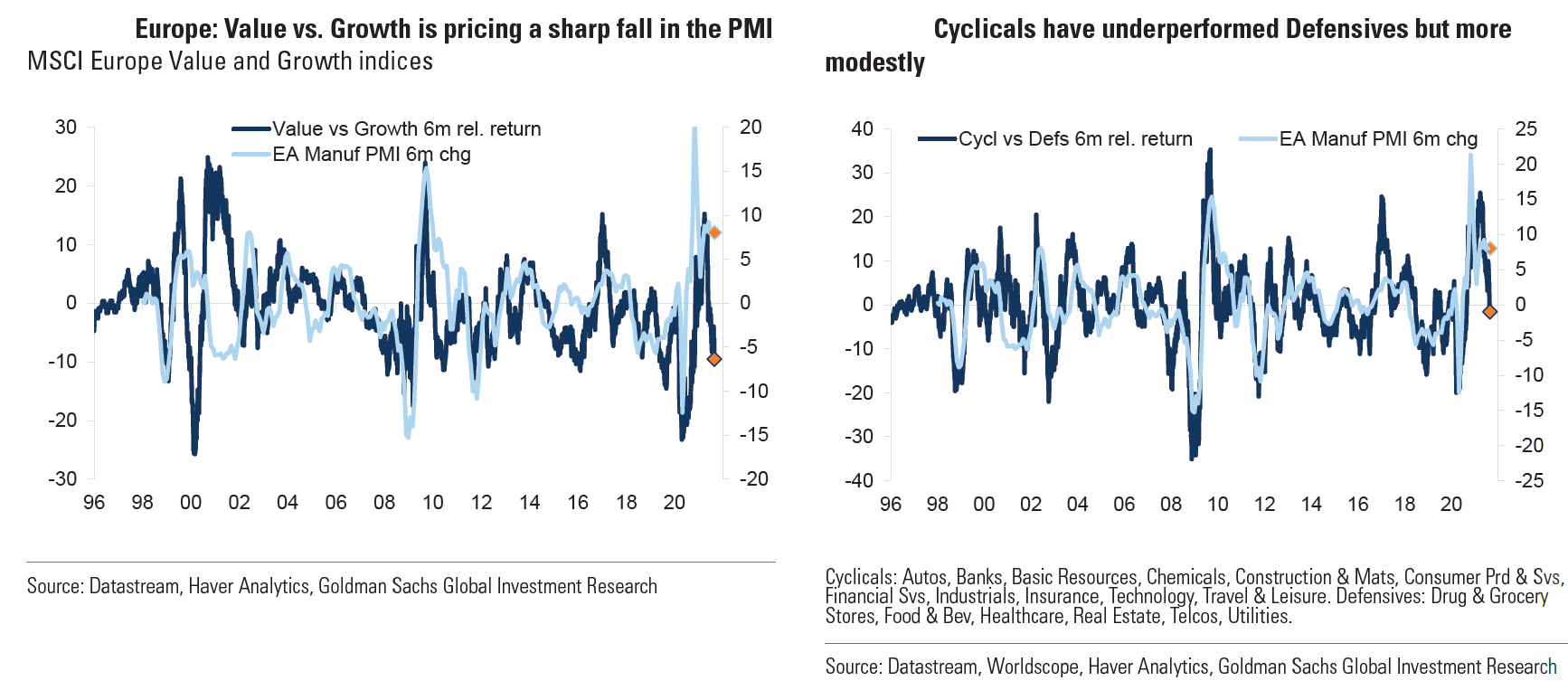

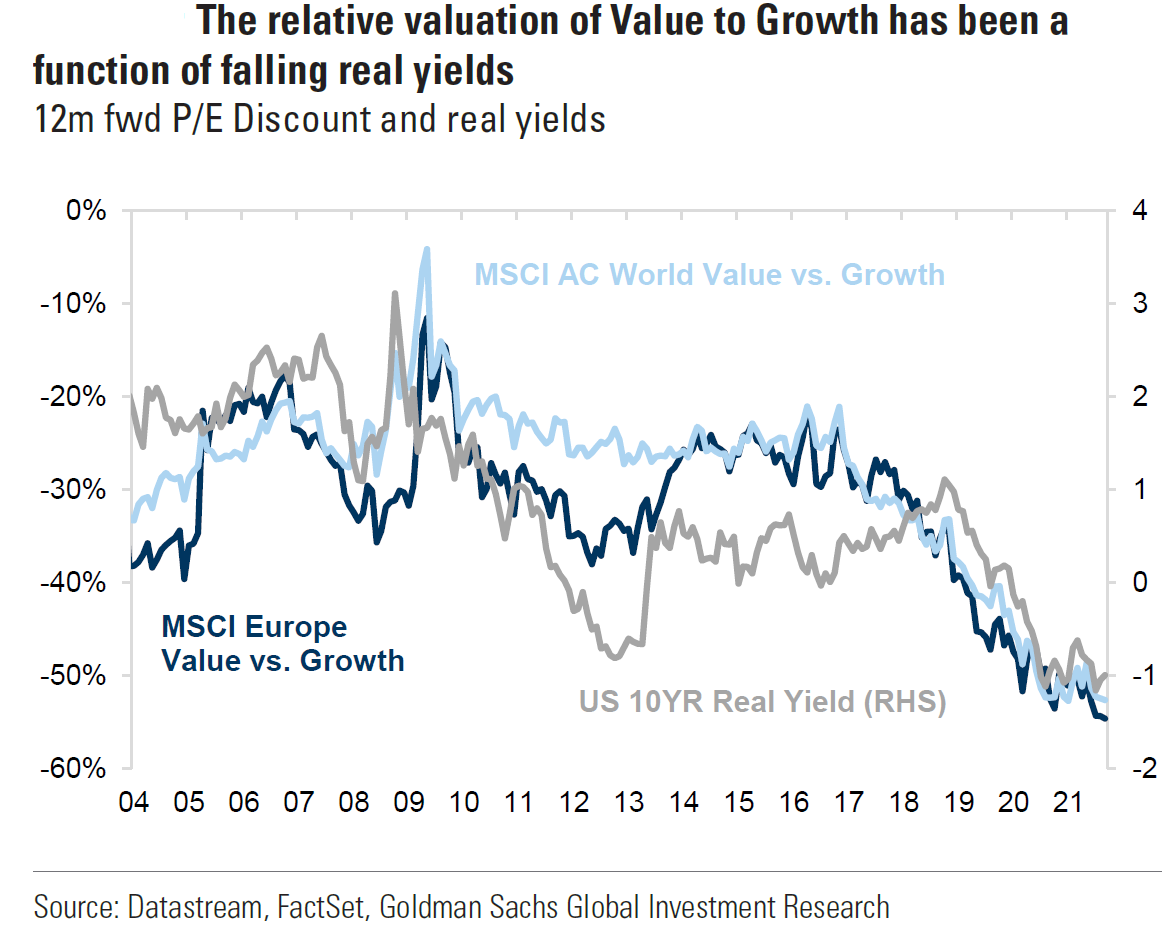

- High U.S. equity valuations and extreme long positioning make overall U.S. equities vulnerable to downturns. Defensive and Growth stocks are discounting mostly “good” news. Value and Cyclical stocks are mostly still discounting a less favorable economic growth outlook and a generally low interest rate scenario.

- Lack of extreme bond positioning before the disappointing U.S. August payroll data enabled interest rates to rise on disappointing headline employment data.

- We believe that the Federal Reserve (Fed) might have to shift its focus from headline employment gains to other measures of a tight labor market so that it could start tapering its asset purchase program on a more timely basis.

The Upshot: We believe that U.S. equity averages are discounting a continuation of a slowing but still growing U.S. economy with continuing low volatility and low interest rates. Excess liquidity also has helped to sustain high equity valuations. The Fed’s Beige Book is one of the most recent confirmations that the Delta variant continues to slow the reopening of the U.S. economy, that it has enhanced the shortage of labor and supplies and has generally slowed the production of many goods and services. Increased inflationary pressures continue to surface due to such disruptions. We expect the Delta variant to become more manageable and for economic growth, especially in the Services sectors, to strengthen. We view the Delta variant’s effects on supply issues and on inflation as much more significant than any potential slowing of demand. We continue to anticipate higher interest rates and a lower USD in the medium term.

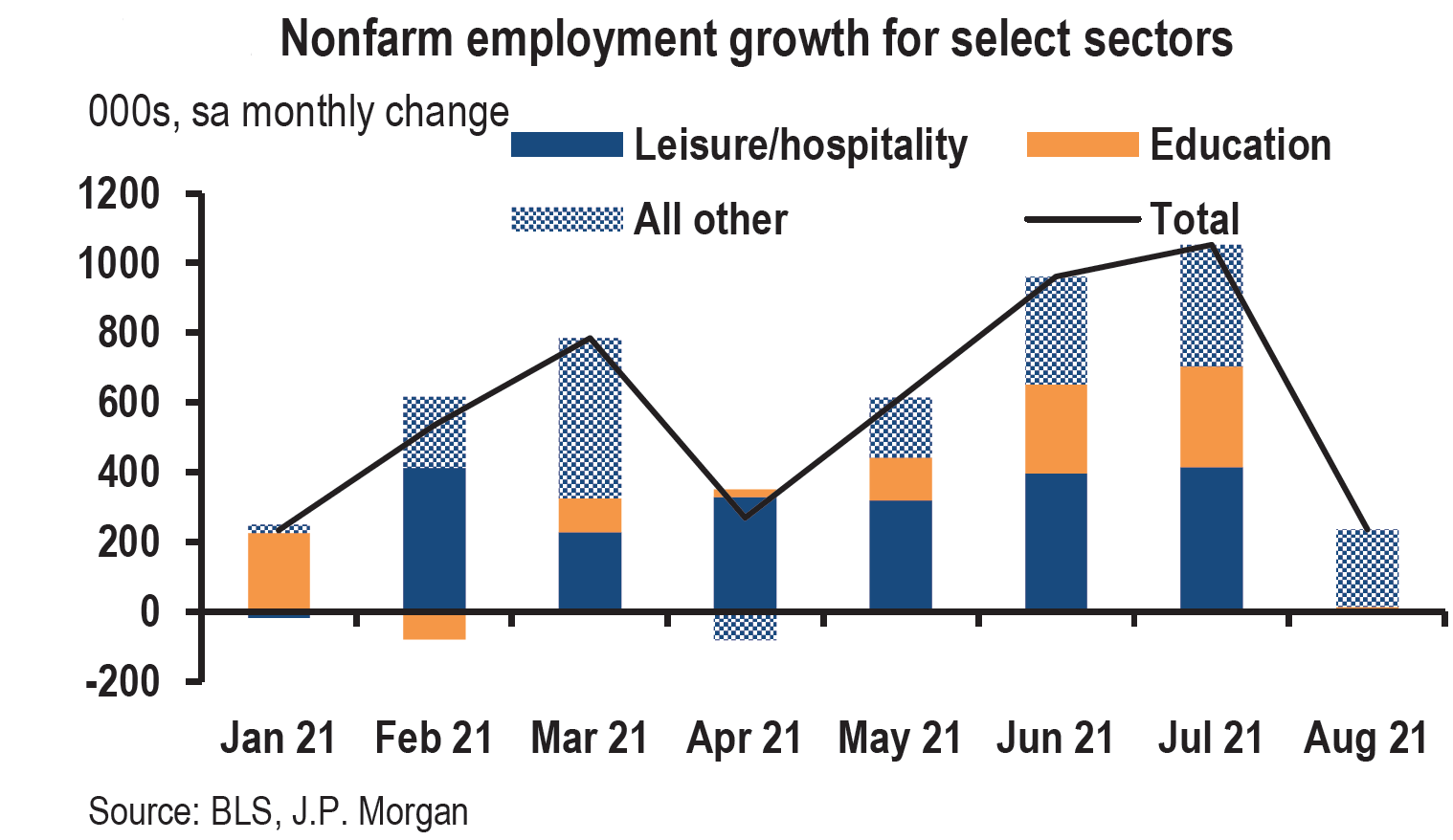

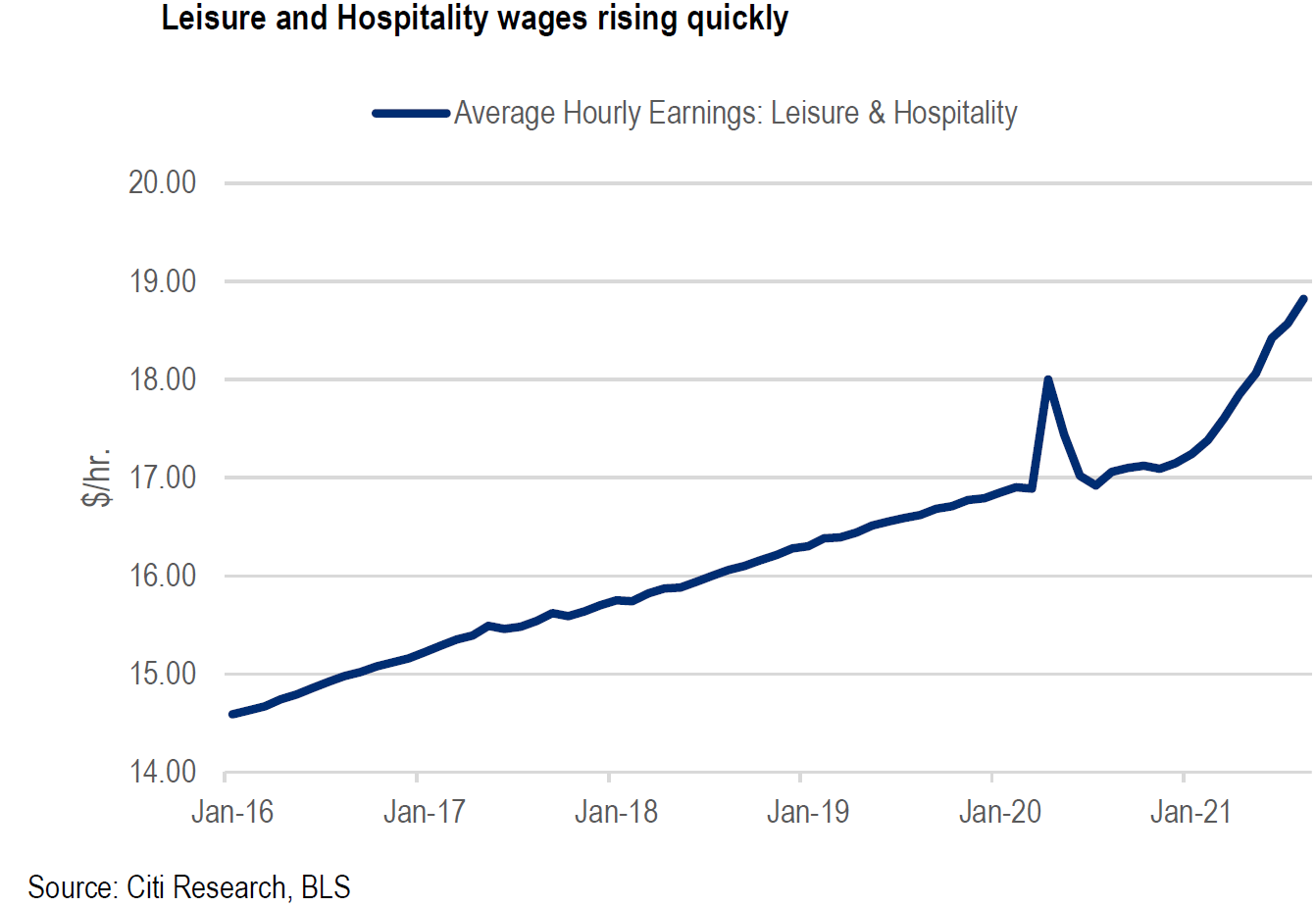

Surprising Interest Rate Rise on Disappointing Employment

As we highlighted in our last weekly letter of August 27, 2021, investor sentiment is most likely to shift when a scenario has been “overly” discounted. In other words, when investor “positioning” has become extreme, market sentiment can shift very quickly. Given the extreme dispersion of investor opinions about inflation, economic growth rates, employment, etc., sometimes a lack of positioning ahead of a significant data point can also lead to surprising market reactions. We believe that such an occurrence led to the surprising 4 bps rise in the 10-year Treasury yield to 1.32% on the day of the announcement of the very disappointing U.S. payroll gain for August. Much of the disappointment was concentrated in the virus sensitive Leisure and Hospitality sector which showed no jobs growth after averaging roughly 400,000 the prior two months. But the persistent tightness of the U.S. labor market was perhaps best illustrated by the better than expected 0.6% m/m (+4.3% y/y) increase in overall average hourly earnings and the +1.3% m/m (+10.3% y/y and the seventh consecutive month of double digit annual wage gains) increase in the Leisure and Hospitality industry. The unemployment rate also notably decreased to 5.2% from 5.4%. We surmise that the Delta variant greatly impacted these data points. According to a J.P. Morgan September 3 report, the number of people teleworking because of the pandemic increased in August for the first time since December 2020. Worker shortages, supply constraints and disruptions continue to persist and most likely affected the headline employment figures.

Source – J.P.Morgan, US Weekly Prospects (9/3/21)

Source – Citi, Jobs report shows tight supply, not weak demand (9/3/21)

The Fed has clearly stated its focus on the headline U.S. employment number as the key area of improvement before it announces a tapering of its monthly asset purchases, making it very improbable that interest rates would actually rise on a much lower than expected employment gain. Unlike earlier this year, when many investors, and especially hedge funds, were short long duration bonds such as the 10-year Treasury bond, expecting rates to go higher, there were virtually no such positions in front of the latest payroll data announcement. In a September 3 report, Goldman Sachs characterized this lack of positioning in the bond market as more “clean.” Interest rates were therefore able to rise much more readily as the markets could look through the Delta variant’s effects on constraining a more substantial rise in employment. Furthermore, interest rates had recently started to generally increase over the past several weeks, but with little conviction of those increases continuing. The bond market was still discounting a slowing economy and temporary increase in inflation scenario at these relatively low rates. There was not enough disappointment in the August data to reverse a continuing “gentle” rise in interest rates.

Slowing U.S. Economy – Unpredictable Employment

Although some economies, like the U.S. and Chinese economies are considered to be past their peak rate of economic growth, we still believe that slowing economic growth rates accompanied by higher inflation are mostly supply constrained more than demand constrained due to the Delta variant. But lately, even demand has most likely been impacted due to supply issues and concerns over the Delta variant. Tangible evidence of this is recent weaker consumer sentiment/confidence, a decline in aggregate hours worked in Leisure and Hospitality, and a decline in some Travel and Entertainment categories which have slowed the rotation of consumer spending from goods to more services oriented categories. Worker shortages and supply chain disruptions were especially evident in low auto sales and longer delivery times. According to auto data firm Motor Intelligence, August U.S. auto sales dropped to an annual selling rate of 13.09 million units (the lowest since July 2020) from its recent April peak of 18.5 million. Shortages of semiconductor chips for auto makers are now expected to persist into 2022. The aftermath of Hurricane Ida might further exacerbate labor supply issues and materials shortages. Shortages of construction workers and some materials, combined with their high prices, also continue to constrain home sales and construction of new homes. The Delta variant effects and impacts from unexpected events such as Hurricane Ida may continue to result in more variable employment gains.

Could the Fed’s Focus Shift from Headline Employment to a Tight Labor Market?

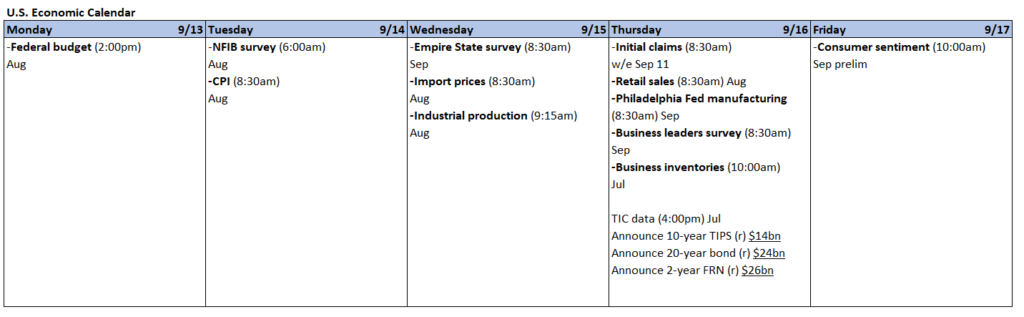

The Fed’s monetary policies really don’t help the above issues as they mostly affect demand for goods and services. In our view, the continuation of easy monetary policies will not overcome supply disruptions and long delivery times. In such an environment easy monetary policies will likely serve to increase inflationary pressures. Based on the Fed’s rhetoric and the statements of many of its members, we believe that the Fed would prefer to start tapering its asset purchase program by late this year. But what if headline U.S. job growth is not “substantial” enough? Perhaps the Fed can then focus more on the tightness of the U.S. labor market to justify beginning to taper. The JOLTS (Job Openings and Labor Market Turnover Survey published monthly by U.S. Bureau of Labor Statistics) data could become a new focus for the Fed. In the latest (July) JOLTS report published this week, U.S. jobs openings increased by a much larger than expected 749,000 over an upwardly revised level for the prior month to a record 10.9 million. This included 1.65 million job openings in the Leisure and Hospitality industry (about 500,000 more than the pre-pandemic peak) compared to about 8.4 million workers unemployed. The quits rate was unchanged at 2.7%, which was close to its record high level. These data points are all indicative of a tight labor market. Likewise, the U.S. Conference Board’s “labor market differential” (jobs plentiful versus hard to get) remains near historic highs. The decreasing unemployment rate down to 5.2% is yet another statistic that the Fed could point to for substantial progress towards full employment. In our opinion, the Fed will find a way to introduce tapering by around year end. We expect bond market positioning to begin to reflect higher interest rates.

Wall Street Getting Nervous

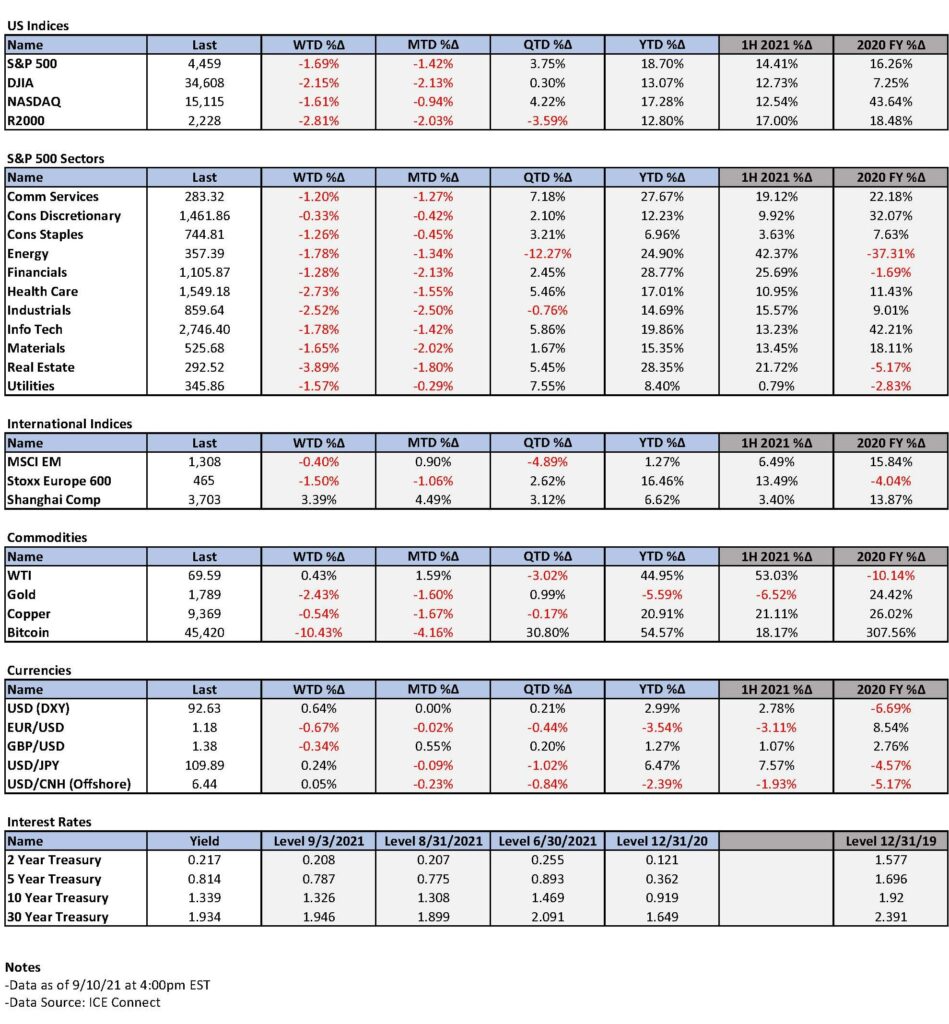

Early this week, strategists at many financial firms such as Morgan Stanley, Citigroup, Goldman Sachs and Credit Suisse all expressed concerns about the high level of U.S. equity valuations. Morgan Stanley even downgraded U.S. equities to underweight and global equities to equal weight. Goldman Sachs said that “high valuations have increased market fragility” and that negative surprises could lead to a “rapid de-risking.” According to Citigroup, “positioning has become ultra-bullish, with longs on the S&P 500 outnumbering shorts by nearly 10 to 1. Half of these bets are likely to face losses on a drop in the index of as little as 2.2%.” Credit Suisse said it maintained a small underweight position in U.S. equities due to reasons such as “extreme valuations” and regulatory risks. According to a September 8 Bloomberg story, the S&P 500 had seven consecutive months of gains through August, the longest such streak since January, 2018. Retail investors invested almost a combined $30 billion of cash into U.S. equities and ETFs in July and August, which is a record amount for a two-month period. Bloomberg Intelligence thought that technical signals pointed to a downturn in U.S. equities, with momentum and volatility suggesting that institutional sentiment was “overheated.”

September is historically the worst month of the year for S&P performance. October is often remembered for very significant and rapid declines. It is not a coincidence that all of these firms are getting cautious at the same time. As we have previously stated, equities’ high valuations are supported by excess liquidity and artificially low interest rates. As we stated in our August 27 letter: “Market volatility could begin at any time.” It now appears that many Wall Street firms share our concern. Extreme bullish positioning by many investors only increases market risks. The market continues to discount the continuation of “good news” and a relatively benign and low volatility regime. What could possibly go wrong?

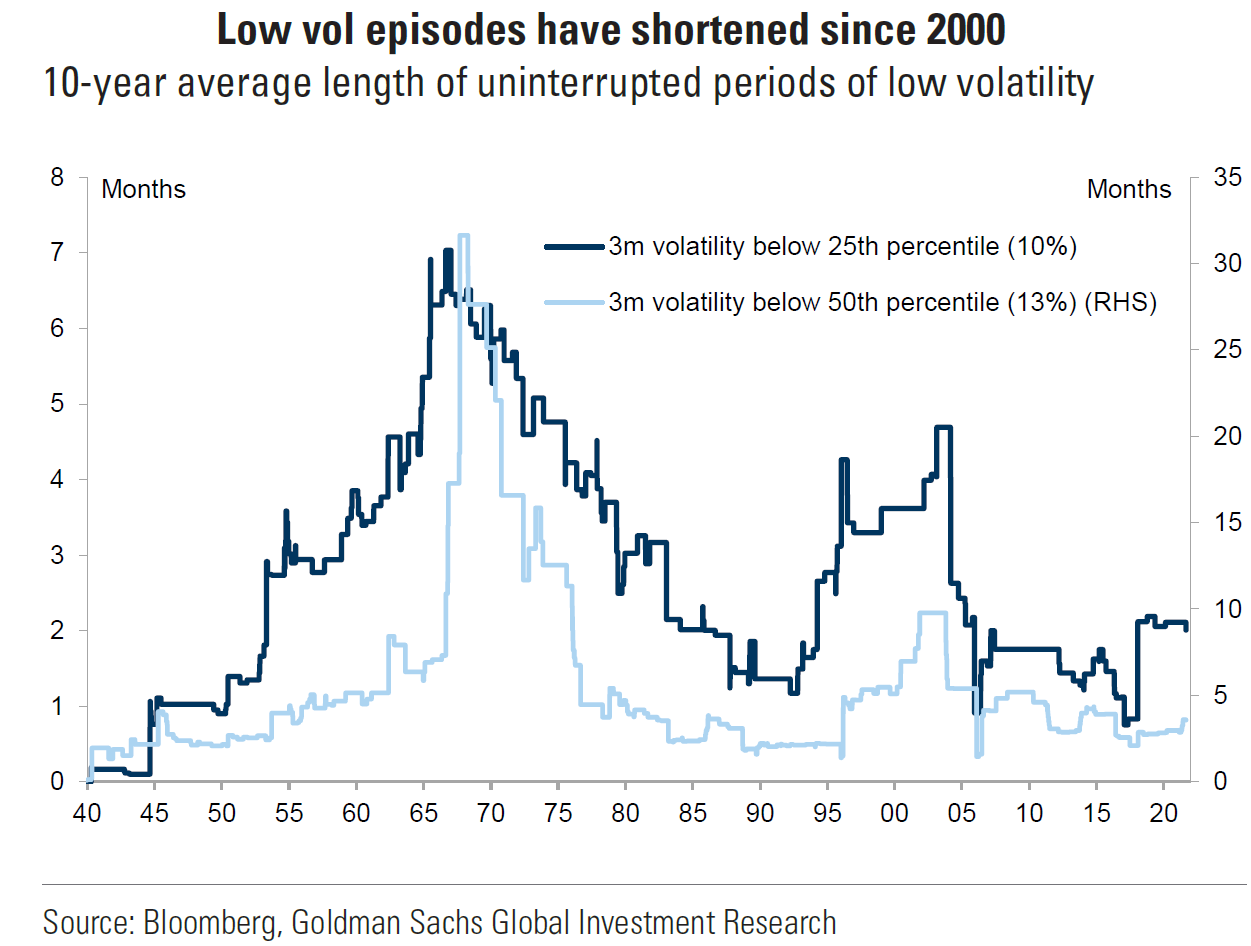

How Long Will Low Volatility Persist?

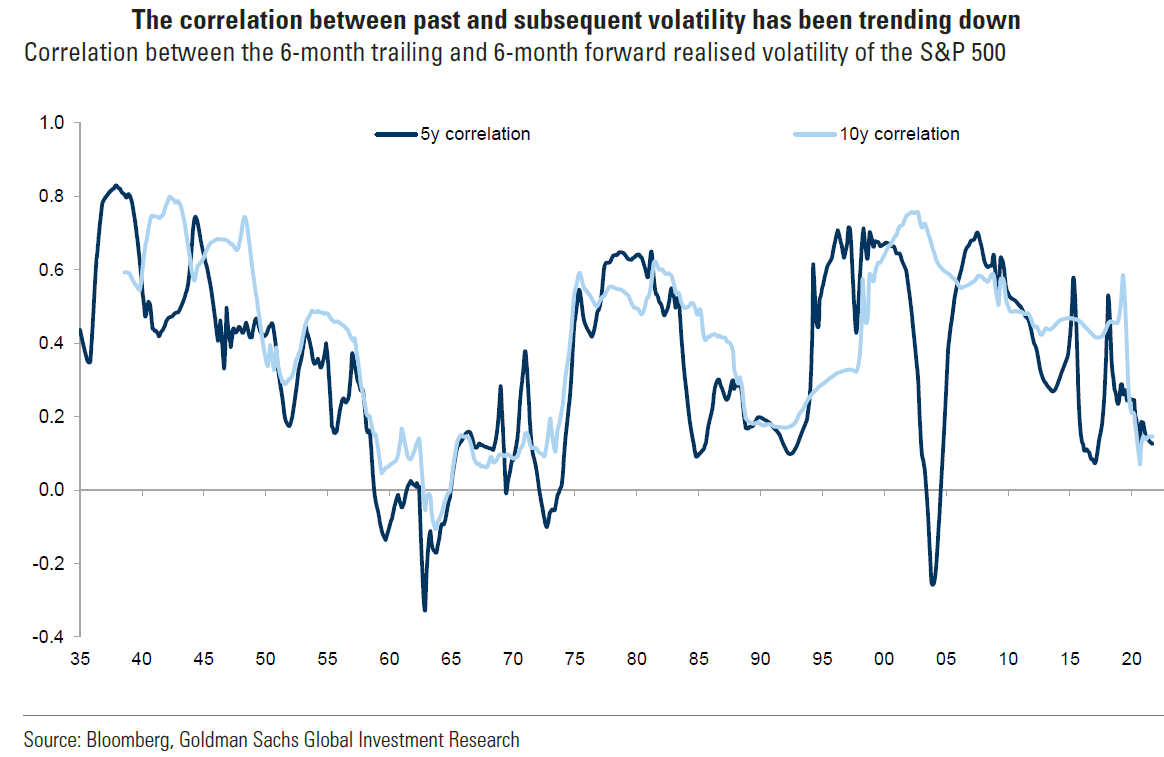

We agree with a Goldman Sachs’ September 7 report that low volatility does not equate to low risk. We agree that high valuations alongside Delta variant risks and concerns and increased macro uncertainty increases the risk of greater volatility at any time. We suspect that overall market volatility has remained low in spite of recent mostly disappointing PMI (economic) data because at least some investors have chosen to look through the disappointing slowing economic growth rates. Other investors perhaps simply assume a continuation of the most recent trends and maintain their positions. We chose to remain optimistic on an economic strengthening as the Delta variant becomes more manageable. We also believe that inflation’s persistence will be longer and of greater magnitude than the Fed anticipates – at least in its rhetoric. Goldman Sachs now believes that fluctuations between low and higher volatility periods will become more frequent and of shorter duration. We agree.

Source – Goldman Sachs, Global Markets Daily: Low Vol Is Not Low Risk — Implications From the Low Vol Regime (9/7/21)

Positioning

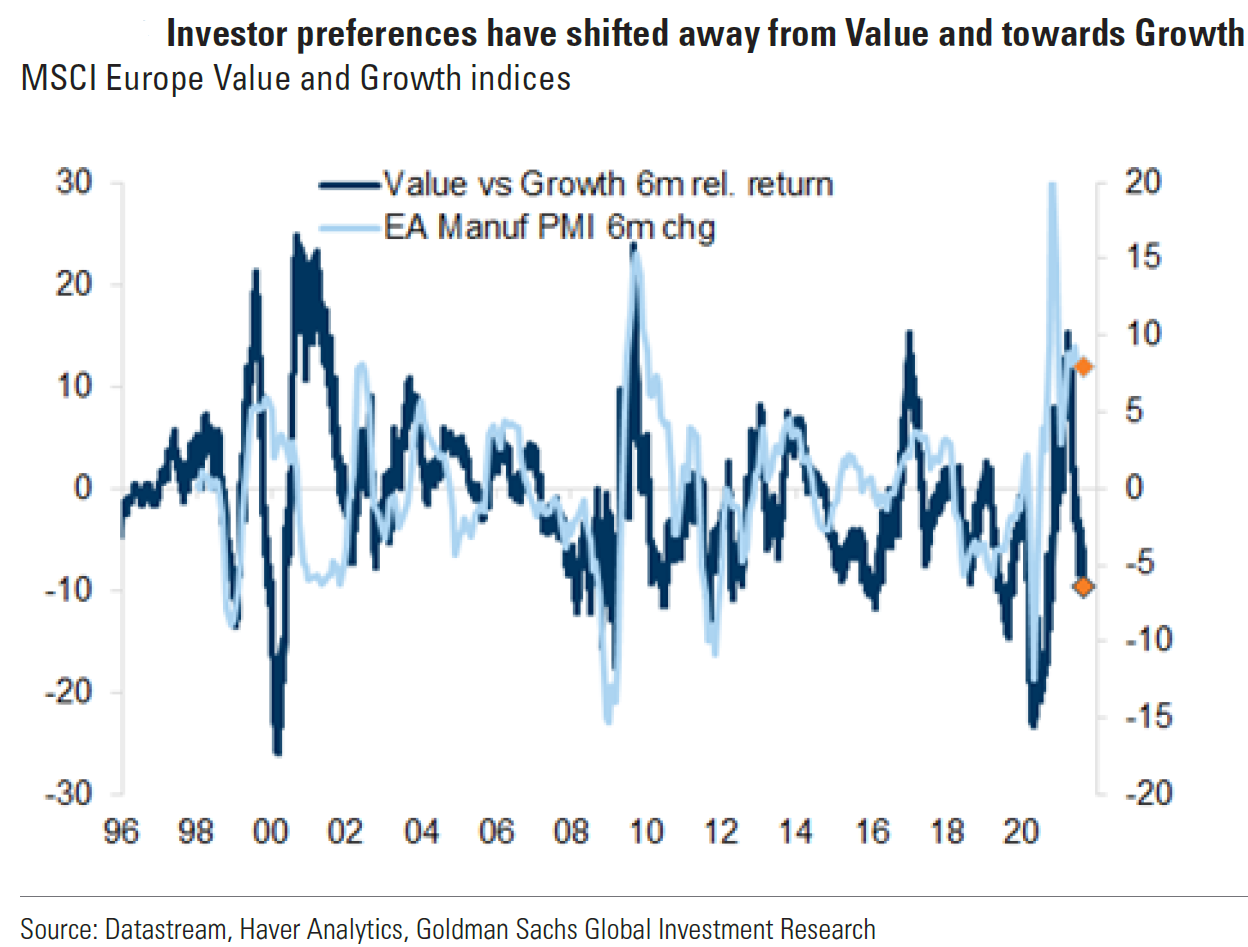

We look for fresh opportunities to buy where potentially favorable news is not properly discounted in our view. We believe that Value and Cyclical stocks overly discount a negative outlook with regard to their companies’ prospects, whereas many more defensive and big cap growth stocks appear to more fully discount very favorable scenarios. Investor positioning reflects these views. We have been very patient in waiting to buy certain stocks when we believe that not enough good news has been discounted or too much bad news has been discounted. An example of a sector overly discounting bad news occurred on Thursday of this week. According to an Associated Press story that day, several U.S. airlines revealed that a rise in COVID-19 cases due to the Delta variant hurt their bookings and further derailed the recovery of the travel industry. The Delta Airlines CEO indicated that the recent rise in coronavirus infections would not derail the travel industry recovery but would delay it by 90-120 days. In general, the U.S. major airlines gained in the 3-6% range during that day. This “bad” news had obviously been overly discounted.

Source – Goldman Sachs, Alpha Opportunities in Europe (9/8/21)

Source – Goldman Sachs, Picking portfolios past the peak (9/7/21)

What’s Discounted?

We continue to believe that the major U.S. equity averages do not reflect a favorable risk/reward to establish new positions in the general equity indexes, especially given the extreme bullish positioning. Examples of factors that probably are either overly discounted or not sufficiently discounted include:

1) Economic growth concerns

2) More persistent and higher inflation

3) Removal of federal eviction ban

4) Cessation of “extra” unemployment benefits for about 10 million people

5) Possibility of increased corporate and individual taxes

6) Decrease in global fiscal benefits

7) Increase in interest rates

8) Weakening USD

9) Strengthening commodity prices

10) Continuing economic slowdown in China

11) Increasing regulatory crackdowns in China

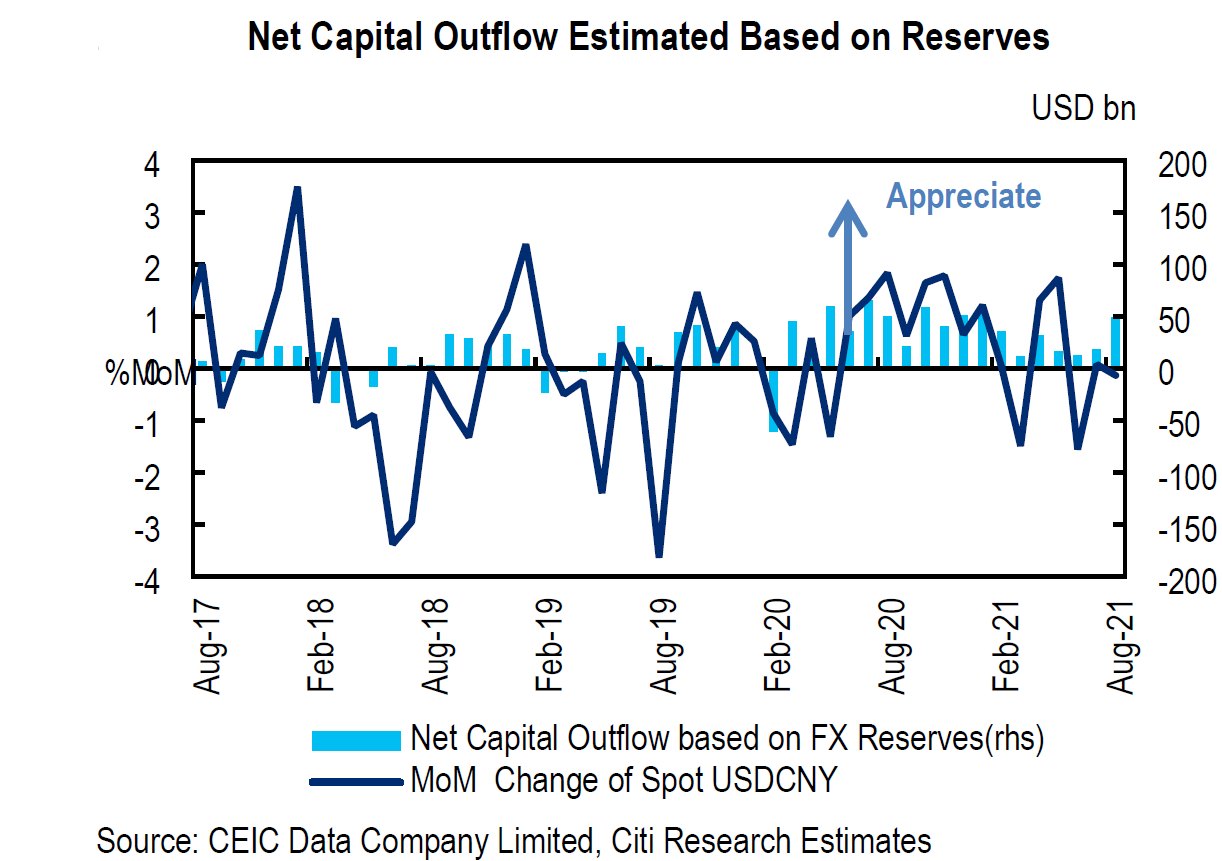

A specific example of China’s continuing regulatory pressures on certain companies occurred during this past week. Even after a previous crackdown on China’s gaming industry had depressed gaming stocks such as Tencent (32% of revenues from video games), Tencent fell about 8.5% on Thursday when Chinese officials “summoned” Tencent and others to discuss further oversight of their industry and that they should end their “solitary focus on pursuing profits.” In our opinion, President Xi Xinping will continue in his quest to increase his control over China, its people and its companies. We expect more regulations and crackdowns to follow. Evidently some Chinese citizens are starting to get nervous as shown by the recent net capital outflow from China (based on the decrease in estimated FX reserves even as the trade surplus increased in August).

Source – Citi, China Economics: Regulatory Actions Explained: High-Quality Opening Up and Market-Based Development Policies Reaffirmed (9/8/21)

Positioning by Region

Positioning differs by region. According to a Citi Research September 7 report, U.S. equity positioning is extended and one-sided net long whereas equity positioning in Europe is much lighter, more moderate and more two-sided (long/short). But if European equities move out of a relatively tight range, longs or shorts could be unwound. Since positioning in German equities is only moderately net long, there is plenty of buying power on the sidelines ready to extend any rallies. The recent rally in the Nikkei 225 Japanese equity index saw only limited investor participation as futures investors inflows accelerated even as modest ETF outflows continued. We believe that certain emerging market equities also present interesting opportunities. MSCI EM is relatively flat this year, whereas US. equities are the best performing relative to the world’s major equity averages. Once again, we look for low positioning in markets which could present attractive buying opportunities and where we might disagree on what’s discounted at various price levels. As expressed in our last letter of August 27, we had a favorable view with regard to international exposure, especially with regard to European stocks. We also expressed a more favorable outlook for EM equities.

Source – Goldman Sachs, Alpha Opportunities in Europe (9/8/21)

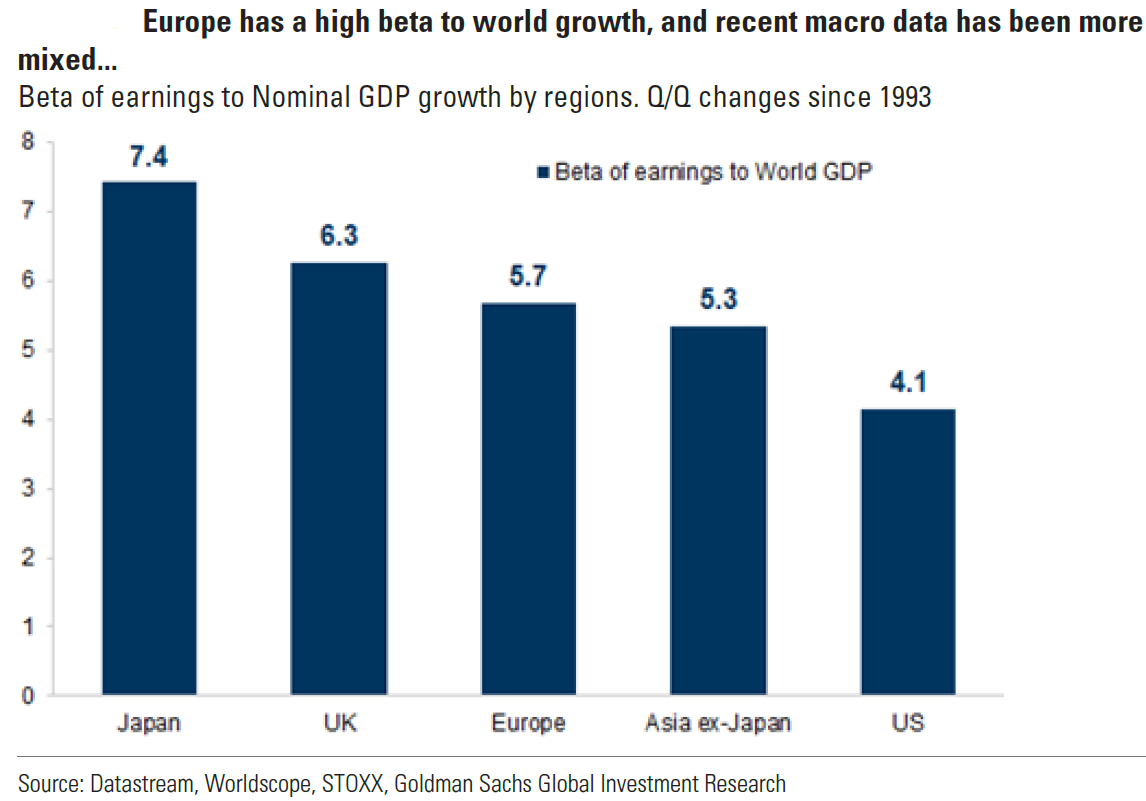

Beta of earnings to World GDP – a measure of earnings sensitivity to World GDP

Fed’s Beige Book Confirms Delta Variant’s Effects

In general, we maintain our belief that most economic slowdowns are due to Delta variant related concerns and effects. The Fed’s Beige Book published this week confirmed this view. It showed that the moderate deceleration in the U.S. economy was largely attributable to a pullback in dining activity and the abatement of travel and tourism in most of the U.S. reflecting safety concerns over the Delta variant. International travel restrictions and shortfalls in production due to supply disruptions, and labor shortages as opposed to softening demand, weakness in auto sales due to low inventories and chip shortages and restrained home sales due to similar issues were also all contributing factors to a slowing of economic growth. All 12 Fed districts reported extensive labor shortages with accelerating wage gains. Input price increases were widespread with pervasive shortages and several districts anticipated significant selling price increases in the months ahead. Most businesses remained optimistic about their near term prospects. The Beige Book is published eight times/year by the Fed and is based on surveys by all twelve of its district banks. It is a qualitative review of financial conditions.

Bottom Line

We believe that the overall U.S. equity averages are at an increased risk of a downturn in the short to medium term. High valuations, excess liquidity, artificially low interest rates and low volatility in the overall averages along with extremely one-sided bullish positioning make these averages very vulnerable. In this environment, adding to or establishing new desired positions should only occur (in our opinion) when an investor’s anticipated scenarios are not fully discounted by the markets. Less one-sided and more moderate positioning could make certain foreign markets more attractive. This could be especially true for European equities which are also more oriented towards Cyclical and Value stocks.

INDEX DEFINITIONS

KBW Nasdaq Bank Index (BKX): The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.

MSCI EM Value Index: The MSCI Emerging Markets Value Index captures large and mid cap securities exhibiting overall value style characteristics across 27 Emerging Markets (EM) countries.

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

NASDAQ: The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

PCE: Personal Consumption Expenditures (PCEs) refers to a measure of imputed household expenditures defined for a period of time.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted and historical growth values.

Russell 1000 Value: The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

S&P 500: The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

VIX: The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Z-Score: A Z-score (also called a standard score) gives an idea of how far from the mean a data point is. It is a measure of how many standard deviations below or above the population mean a raw score is.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2021 NewEdge Capital Group, LLC